how to figure out sales tax on car

If youre a buyer transferee or user who has title to or has a motor vehicle or trailer youre responsible for paying sales or use tax. When you buy a new vehicle the calculation is simple.

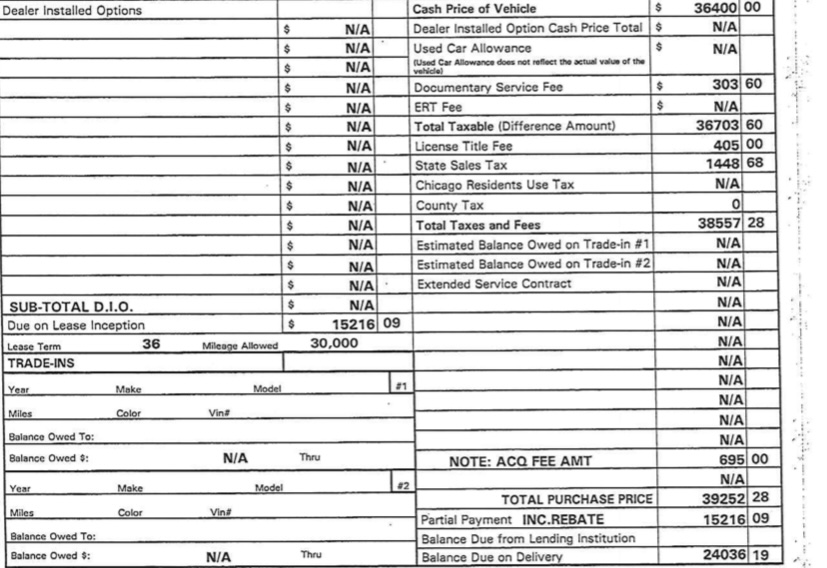

The Correct Tax Amount For Illinois Ask The Hackrs Forum Leasehackr

You can use our New York Sales Tax Calculator to look up sales tax rates in New York by address zip code.

. A title fee is 21 when you purchase a vehicle in California. The calculator will show you the total sales tax amount as well as the. Missouri Sales Tax on Car Purchases.

A registration fee can range from 15 to 500 after you purchase a vehicle in California but you need to pay the fee. 1 day agoBefore we talk about how to avoid sales tax on a used car lets put sales tax into perspective. There is also a.

For example say you buy a used car from a dealership in Los Angeles. To calculate the sales tax on your vehicle find the total sales tax fee for the city. Vehicle excise tax is levied every April based on the vehicles model make and year.

To calculate the sales tax on your vehicle find the total sales tax fee for the city. How do I calculate sales tax on a car in Virginia. The sales tax you pay is based on auto tax regulations in your municipality and is not typically influenced by whether the car is.

Multiply the vehicle price before trade-in or incentives by the sales. Usually the vendor collects the sales tax from the consumer as the consumer makes. 54 rows A sales tax is a consumption tax paid to a government on the sale of certain goods and services.

The minimum is 725. Multiply the vehicle price after trade-in but before incentives by the. This means that if you purchase a new vehicle in Connecticut then you will have to pay an additional 635 of the final purchase price of the vehicle.

Missouri collects a 4225 state sales tax rate on the purchase of all vehicles. Code 581-2402 Virginia levies a 415 Motor Vehicle Sales and Use SUT Tax based on the vehicles gross sales price or 75. 625 sales or use tax.

Motor vehicle or trailer sales. According to Car and Driver the state of Massachusetts imposes a 65 sales tax on all vehicle sales in the state. How is tax calculated on a new car purchase.

How much is sales tax on a 4000 car in Missouri. Motor vehicle dealers and motor vehicle leasing companies must collect the additional sales tax of three-tenths of one percent 03 of the selling price on every retail sale rental or lease of. The minimum is 65.

How To Calculate Missouri Sales Tax On A Car. Lets say your new. You can calculate the Missouri sales tax on a car by multiplying the vehicles purchase price by the Missouri state sales tax.

MyDORWAY is the South Carolina Department of Revenues online tax portal and it can.

New York Car Sales Tax Calculator Ny Car Sales Tax Facts

Texas Vehicle Sales Tax Fees Calculator Find The Best Car Price

Arizona Sales Reverse Sales Tax Calculator Dremployee

Arkansas Legislators Work To Cut Sales Tax On Used Vehicles

California Bill Would Reduce Sales Tax On Green Cars Los Angeles Times

How Colorado Taxes Work Auto Dealers Dealr Tax

How To Qualify For The Vehicle Sales Tax Deduction Carvana Blog

Can I Avoid Paying Sales Taxes On Used Cars Phil Long Dealerships

County City Calculate Sales Tax Loss From Leakage To Oregon The Columbian

United States Taxes Charged On Car Rental Bill Are They Sales Taxes Personal Finance Money Stack Exchange

How To Calculate Sales Tax How To Find Out How Much Sales Tax Sales Tax Calculation Youtube

_(1).jpg)

Deduct The Sales Tax Paid On A New Car Turbotax Tax Tips Videos

What Is The Sales Tax On A Car In Illinois Naperville

/images/2022/02/08/woman_in_car.jpg)

How To Legally Avoid Paying Sales Tax On A Used Car Financebuzz

2021 Arizona Car Sales Tax Calculator Valley Chevy

Illinois Trade In Tax Coming Chicago Il Marino Cdjr

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Illinois Imposing Car Trade In Tax On Jan 1 Dealers Call It Double Taxation